World in Five

Your 5-minute update in risk appetite | June 2022

Solutions & Know-how: The new Credendo Global Flex terms: clearer, simpler, more consistent.

The new Credendo Global Flex product offers you our tailor-made cover in a user-friendly structure, wording and design: rapidly scannable, easy to understand, aimed at complete clarity, and erasing all possible misunderstanding.

The aim is to speak the very same language. Understanding each other smoothly with absolute clarity makes working together towards effective, tailor-made solutions so much easier.

User-friendly documentation structure

- General Terms (GT) lay out the policy principles and processes and may be supplemented by:

- Extensions to the General Terms, describing special policy features, such as extra cover for bank guarantees and termination risk, discretionary limits, local law requirements, etc.;

- Loss Payee or Pledgee annex, approving the transfer to a third party of the right to receive indemnity;

- Broker annex, confirming the involvement of the broker.

- The Specifications List defines the scope and specific conditions of the policy.

- Risk Acceptances state Credendo’s decisions on whether it accepts risks on debtors/transactions. It is the new terminology for both credit limits and contract approvals.

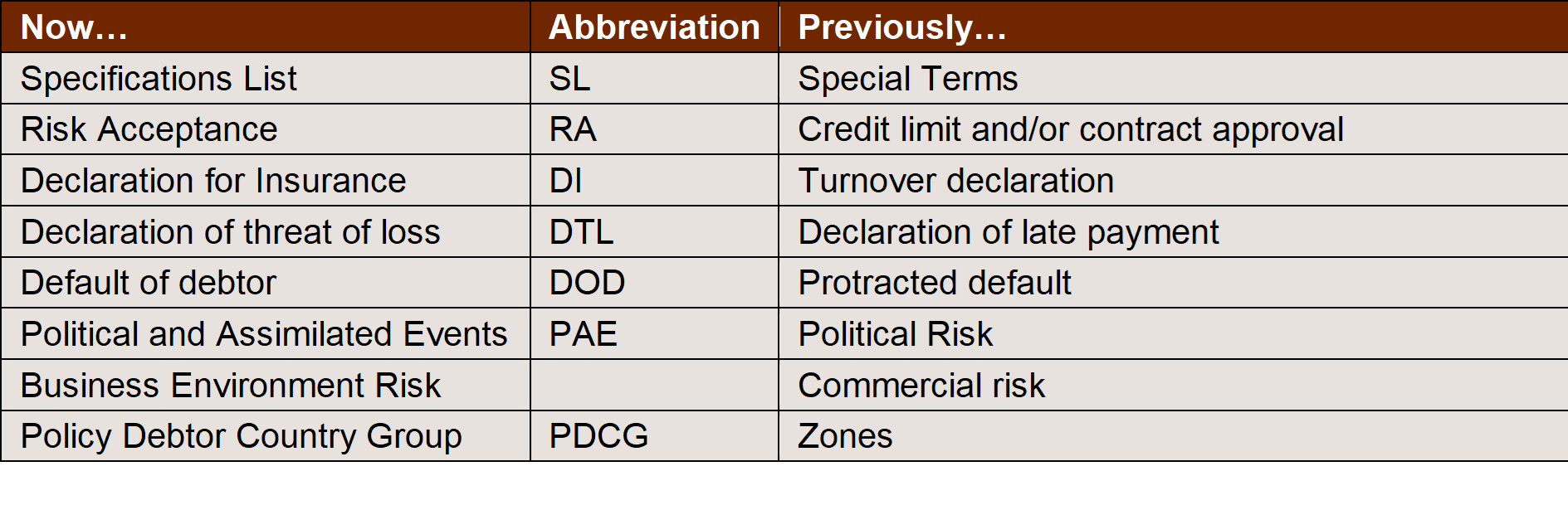

Terminology and abbreviations

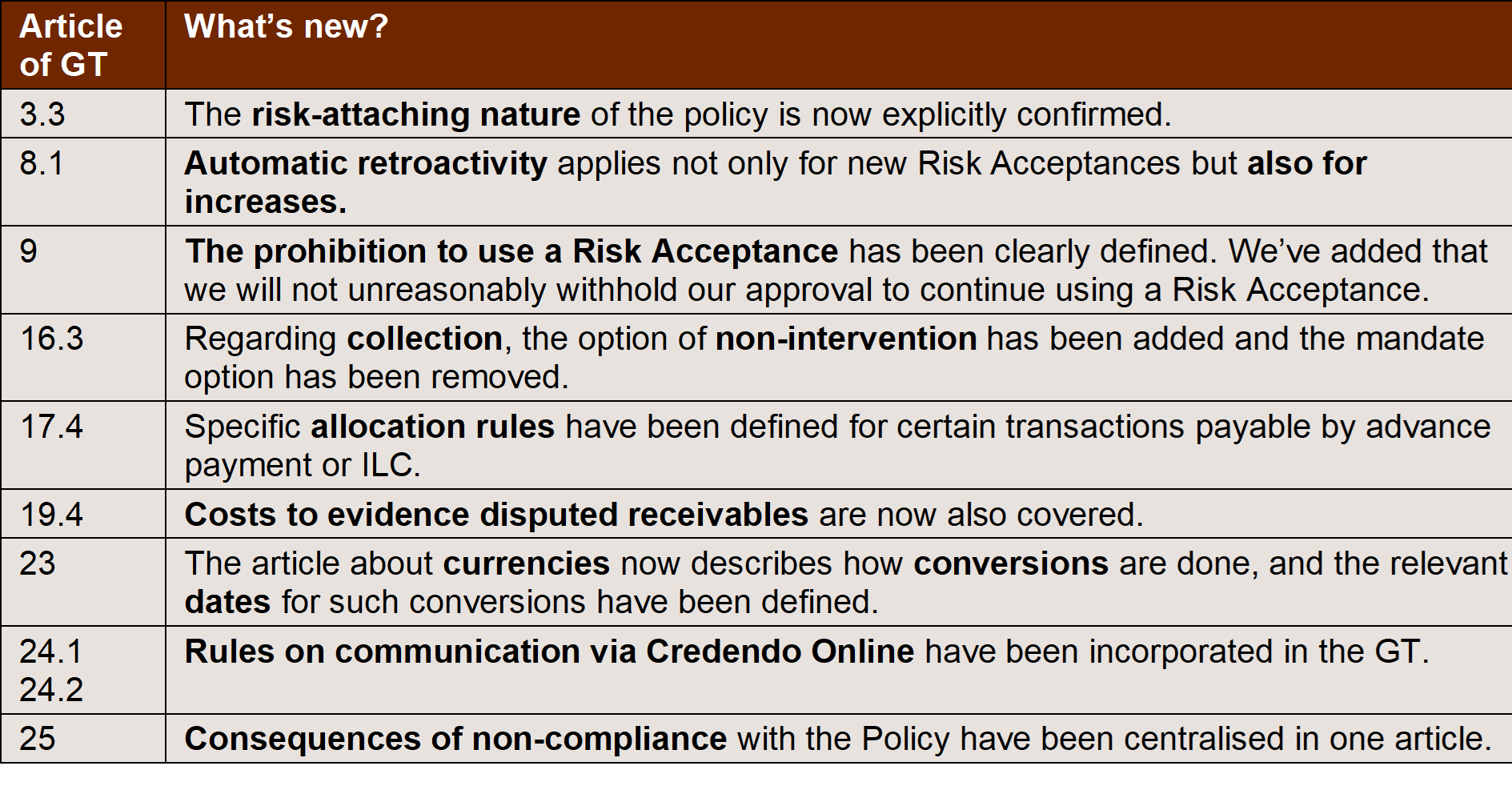

Credendo Global Flex: an overview of major improvements

Questions? Remarks? More information? Your Account Manager will gladly help you. In full clarity.

| Country Risk How the Russia-Ukraine conflict impacts the energy sector. Why Europe risks to be particularly affected. Read more |

|

|

Case Have you discovered our new digital platform? Let us make your life easy for you. Read more |